The Liberal Party’s successful election campaign included a promise to stimulate the economy by increasing infrastructure spending with deficit budgets. How will these changes effect the country’s real estate market? Until details are released, the exact consequences are difficult to determine, but some possibilities have emerged. Foreign Investment We don’t know what will follow the Liberals’ change in fiscal direction (deficit spending versus balanced budgets), but, if the promised infrastructure spending materializes, it could boost annual growth in 2016 and 2017 “by up to 0.1 and 0.3 percentage points respectively,” according to a TD Bank report.

Read More

Archives for Real Estate Information

Home Improvements – Do It Yourself Or Hire A Professional?

Completing a DIY project can be tremendously fulfilling and financially rewarding. But, bite off more than you can chew, and you might be looking at some major expenses to fix the damage or, even worse, a catastrophic incident. Before grabbing your toolbox, accomplish a quick risk-reward analysis. Then, determine if you have the skills and tools for the project. Finally, decide if you have the available time and are inclined to invest it in the task. These guidelines will help you decide whether to swing a hammer or write a cheque. Reno Risks And Rewards First weight the expected benefits

Read More

4 reasons to buy a home before the end of the year

Does cooler weather mean that you should cool down your house hunt? Absolutely not! Sellers who have homes listed during the colder months are usually motivated to sell and list prices are typically lower in December…but wait…there’s more! Traditionally, housing markets cool down at year end, but this Business Insider post suggests taking advantage of four factors that could work in your favour. First, borrowing rates are exceedingly low and that means you save a bundle. In addition, the seasonal slowdown means fewer buyers submitting competing bids for choice properties which could put you in a strong negotiating position. There

Read More

How Will Legalized Pot Affect Canadian Real Estate Markets

No matter what you think about the ethics or morality of legalizing marijuana, Justin Trudeau’s Liberal government has promised to do just that during their first term. The fact is, we started down that path when medical marijuana was legalized. So, how will this impact real estate markets in Canada? The Colorado Housing Market Exploded We see clues to the impact of mainstreaming the recreational marijuana business in Colorado, the first state to replace prohibition with regulation. On 01 January 2015, they celebrated their first year with operational adult use marijuana stores and, perhaps coincidentally, there

Read More

Market Update | Ottawa Real Estate Stats October 2015

Here are the latest statistics from the Ottawa Real Estate board. Statistics are useful in establishing trends but should not be used as an indicator of an increase or decrease in value of specific properties. If you are curious about the value of your home and/or specific neighbourhood statistics please contact us anytime, we would love to help. Information below has been provided by the Ottawa Real Estate Board “October Home Buyers weren’t spooked by election results.” Members of the Ottawa Real Estate Board sold 1,161 residential properties in October through the Board’s Multiple Listing Service® System, compared with 1,119

Read More

Home Buyers: To Inspect, or Not To Inspect

To Inspect, or Not To Inspect You’ve just purchased your dream home and your salesperson is recommending an home inspection before signing the final conditions. Is it worth $400-500? Now is the time to ignore your emotional attachment to the property, and make this a business decision. The answer is, “Absolutely!” The inspection is a critical step that ensures the structure, environment and operating systems of your dream home are safe and sound. We are sometimes seduced by facade or the presentation of a property , but the things we cannot see can lead to expensive repairs or health concerns.

Read More

Income Properties: What You need to Know about Buying an Investment Property

“Don’t wait to buy land, buy land and wait” – Will Rogers Income Properties: Are you Ready? Owning a rental property may seem like a licence to print money. Interest rates are low, the Ottawa Real Estate Market is stable …what could be easier? Buy a property, lease it, collect cheques and plan your retirement. But…before purchasing an income property, you should be aware of the benefits and drawbacks. Advantages of Income Properties: You pay less tax. Because your secondary property is a business, you can deduct certain expenses from your income (mortgage interest, property taxes, insurance,

Read More

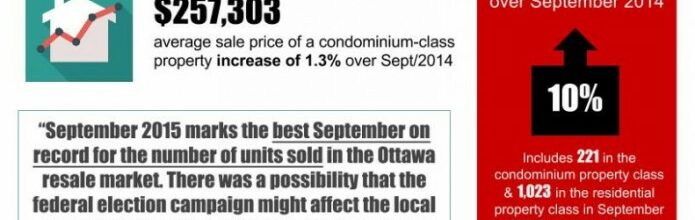

Best September on record for number of Ottawa Real Estate resales!

What a great month for Ottawa Real Estate! See below a snap shot of what’s happening in the Ottawa Real Estate Market from the Ottawa Real Estate Board published October 5th, 2015 Interested in a specific neighbourhood? We have access to all of the latest real estate statistics at our fingertips! Please contact us and we will send you a no-cost report on the areas you want to know about. From OREB news: Members of the Ottawa Real Estate Board sold 1,244 residential properties in September through the Board’s Multiple Listing Service® System, compared with 1,131 in September 2014, an increase of

Read More

The Inside Scoop on the Best Season to Sell Your Home

Think you need to wait until Spring to sell your home? You may want to think again if you’re ready to sell now. In this HGTV.com post, Gavin Chen challenges conventional wisdom that the best time to sell is spring and the best time to buy is fall. Statistically, spring has the most competing sellers in the market, so you might have to stage your home to get an advantage. Chen suggests it is important to highlight the sellable features of your home in any season. Although there are fewer buyers in the December – January period (holidays, travel),

Read More

Your Annual Home Maintenance Schedule

Following an annual maintenance schedule is an essential step in protecting the value of what will probably be the largest investment of your life – your home. First time home owners, or those lacking experience may struggle with this task and overlook important elements. Here are some guidelines to help you create a maintenance program that suits your needs. Benefits of Home Maintenance Regular preventive maintenance identifies minor repairs before they become expensive, major repairs. It also preserves your home’s market value. One study found that “greater than $5 return for every $1 spent on preventive maintenance is not unusual”.

Read More