Pets are a very important part of many Canadians lives. In 2014, it was estimated that 57% of Canadians owned pets which equates to approximately 7.5 million households. In many cases, our pets become part of our families to the point where terms like “pet parent” and “fur baby” are used to define this unique relationship. But what impact do pets have when it comes to real estate? Buying a Home with our Pets in Mind Pets affect our choices in real estate. When we buy a home, we consider the needs of our family, which often enough includes our

Read More

Archives for Real Estate Information

Getting Ready to Buy in the Spring Market

Maybe you are a first-time home buyer, or maybe you will be selling a home and looking for something new, either way the spring real estate market is fast and approaching and you want to be ready. This is an exciting time of year in the real estate industry and for everyone buying and selling homes. It can be a little crazy though, so here are some tips to help you be prepared. It’s not too early to start getting ready. Get Mortgage Pre-Approval You will want to start off by setting up a meeting with a mortgage broker or

Read More

Ottawa Real Estate February Highlights – “Primed for a Competitive Spring Market”

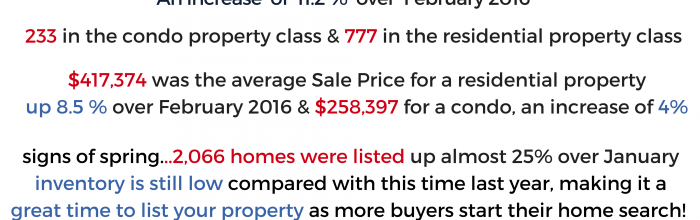

Spring market primed for a competitive season ahead! FEBRUARY 2016 MARKET HIGHLIGHTS: 1010 Residential properties were sold through Ottawa MLS® (including 233 in the Condominium class and 777 residential properties) Average Sale Prices: $417, 374 (Res +8.5%) and $258,397 (Condo +4%) Increased number of residential properties selling in the $750K-1Million resulted in a higher Average Sale Price. 2066 homes listed, up almost 25% over January 2017 Most active price point was in the $300K-$399K range, followed by the $400,000 to $499,999 range, accounting for 54.6 per cent of the market (combined) Information below taken from OREB OTTAWA, March 3,

Read More

Ottawa Real Estate February Highlights – "Primed for a Competitive Spring Market"

“Spring market primed for a competitive season ahead!” FEBRUARY 2016 MARKET HIGHLIGHTS: 1010 Residential properties were sold through Ottawa MLS® (including 233 in the Condominium class and 777 residential properties) Average Sale Prices: $417, 374 (Res +8.5%) and $258,397 (Condo +4%) Increased number of residential properties selling in the $750K-1Million resulted in a higher Average Sale Price. 2066 homes listed, up almost 25% over January 2017 Most active price point was in the $300K-$399K range, followed by the $400,000 to $499,999 range, accounting for 54.6 per cent of the market (combined) Information below taken from OREB OTTAWA, March 3,

Read More

Getting Your Home Ready to Sell in the Spring Market

Selling your Home in Spring The spring real estate market is quickly approaching and if you’re selling your home, now is the time to start getting ready! It may seem like a daunting task but there are things that you can do to make sure that your house is prepared for the droves of spring buyers this upcoming season. Remember, there will be many houses on the market at the same time as yours so you want to make sure that your property is ready and sticks out for buyers! Contact a Realtor®. Real estate agents are professionals. A great

Read More

Why Move? A Look into Canada’s Homebuyers

How many times have you moved (so far) in your lifetime? Once? Twice? For a brief time while in school? Work? Or have you moved far too many times to even count? What about those times that you have moved from one place to another, were they on your own? Were they with your family? Your partner? A few friends? And did you live in these homes for long enough to consider it a home? Sure, the vast majority of us may answer differently to each of these questions, but we do share one common factor: the overall experience. Truth

Read More

Why Move? A Look into Canada's Homebuyers

How many times have you moved (so far) in your lifetime? Once? Twice? For a brief time while in school? Work? Or have you moved far too many times to even count? What about those times that you have moved from one place to another, were they on your own? Were they with your family? Your partner? A few friends? And did you live in these homes for long enough to consider it a home? Sure, the vast majority of us may answer differently to each of these questions, but we do share one common factor: the overall experience. Truth

Read More

The Bank of Mom and Dad: Living as Millennials

It’s no secret: the cost of living is expensive. Regardless of who we are and what we do, we live and breathe steep living costs day in and day out. It’s a fact of life: if we’re not saving our pennies, we’re spending them; if we’re not paying off one bill, we are another. It’s the never-ending cycle of our (financial) lives. Enter: mom and dad. For the vast majority of us, mom and dad means home; and home is where the heart is, after all. It’s become a common trend among many baby boomers to take part in

Read More

Beating the Winter Blues

It’s winter time in our Nation’s Capital! The New Year is well underway, and as we’ve carefully selected our resolutions (and have spent the majority of these last few weeks trying to abide by them) we reminisce on the post-joys of Christmas and the excitement of a New Year. However, regardless the amount of joy in our hearts and happiness in our homes, the cold weather tends to overstay its welcome far too often. Admit it, we’ll soon catch ourselves wishing for less snow, warmer weather, and oodles upon oodles of sunshine. Wishful thinking, I’ll say. Truth is, we live

Read More

Housing Trends in 2017

The New Year is officially underway and we are ready to reflect on the year that has passed, as well as plan for the year that’s to come. With the housing market being consistently ever-changing, new trends tend to surface as old ones seem to fade. 2016 was a big year for the housing market and, as a result, we saw some pretty impressive reports, results, and trends. This year, the housing forecast and its trends will predictably be as follows: The Canadian Real Estate Association has released recent information on Canada’s housing trends and how they’ve evolved since

Read More